How to Demonstrate DORA Compliance: A Best Practices Checklist for Mitigating ICT Risk

The Digital Operational Resilience Act (DORA) represents a landmark regulation within the European Union, aimed at bolstering the digital operational resilience of the financial sector. DORA mandates that all entities operating within the financial services sector, including banks, insurance companies, and other financial entities, adhere to stringent IT security standards, risk management requirements, and incident reporting protocols to manage and mitigate Information and Communication Technology (ICT) risks effectively.

The essence of DORA compliance lies in its focus on enhancing the digital resilience of the financial industry against a backdrop of increasing cyber threats and ICT disruptions.

Understanding and demonstrating DORA compliance is crucial not only to avoid the significant penalties and fines associated with non–compliance but also to foster trust with customers and stakeholders by ensuring the reliability and security of financial services.

This guide provides an authoritative overview of the ICT risk mitigation requirements regulators need to see from financial services organizations as part of the DORA compliance mandate. We encourage you to leverage the enclosed best practices checklist, focusing on mitigating ICT risk. This checklist and the additional strategies shared should help your organization not just demonstrate compliance, but also bolster your defenses to mitigate the risk of a data breach, compliance violation with other regulatory compliance laws, customer loss, and brand erosion.

DORA Compliance Overview

The Digital Operational Resilience Act (DORA) is a set of comprehensive regulations aimed at strengthening the digital resilience of financial entities within the European Union (EU). DORA compliance is essential for ensuring that these entities can withstand and quickly recover from digital disruptions, cyber-attacks, and other ICT-related risks.

DORA compliance is required for a wide range of entities, including banks, insurance companies, and investment firms. While demonstrating compliance with any regulation can be a daunting process, they typically benefit organizations in the long-term. DORA compliance, for example, benefits financial entities by providing them a robust framework to improve their digital defenses, thereby safeguarding sensitive data and maintaining customer trust.

DORA Requirements

One of the fundamental requirements of DORA compliance involves implementing robust digital resilience strategies. These strategies are designed to help entities anticipate, prepare for, and respond to digital incidents that could disrupt their operations. Digital resiliency implies organizations can minimize potential financial losses, protect sensitive data, and maintain customer trust. To achieve digital resiliency, organizations must identify and assess their critical ICT assets, establish contingency plans, and conduct regular stress tests to ensure their systems can withstand various threat scenarios.

DORA ICT risk mitigation is another crucial requirement of the compliance process. This involves identifying, assessing, and managing the risks associated with information and communication technologies. Financial entities must implement measures to protect their ICT infrastructure, such as adopting advanced cybersecurity practices, regularly updating software and firmware, and conducting thorough risk assessments. By doing so, they can reduce the likelihood of cyberattacks and other digital disruptions.

Importance of ICT Risk Mitigation in DORA Compliance

ICT risk mitigation is at the heart of DORA compliance. The prevalence of ever–increasing sophisticated cyberattacks threaten the operational resilience and stability of financial entities all over the world. DORA’s stringent IT security standards and risk management requirements are designed to ensure that financial services organizations are well–equipped to identify, assess, and manage these risks effectively. This proactive approach to risk management is critical for maintaining the integrity, availability, and confidentiality of ICT systems and services, which are fundamental to the operational functionality of the financial sector.

DORA Compliance Benefits

DORA compliance offers a strategic advantage to financial services organizations by establishing a robust framework for managing Information Communication Technology (ICT) risks and ensuring digital resilience. By adhering to DORA IT security standards and fulfilling DORA risk management requirements, entities not only safeguard their operations but also gain a competitive edge in the ever–evolving digital landscape.

The implementation of a DORA compliance checklist guides organizations through the essential steps needed for mitigating ICT risk, emphasizing thorough preparation and proactive measures. This systematic approach not only minimizes the potential impact of digital threats but also streamlines the process of identifying and addressing vulnerabilities, thereby enhancing overall operational efficiency.

For customers and partners, DORA compliance signifies a commitment to safeguarding sensitive data and ensuring the continuity of services, regardless of external challenges. This level of trust is invaluable, fostering stronger relationships and contributing to a positive reputation in the marketplace. Implementing digital resilience strategies as part of DORA compliance further ensures that organizations can quickly recover from incidents, maintaining high availability and minimizing disruption to users.

In addition, because DORA compliance is comprehensive, covering aspects from risk assessment to incident reporting, it provides a clear framework for continuous improvement. Financial services organizations benefit from an iterative process of enhancing their security posture and resilience capabilities, ultimately leading to a more robust financial ecosystem that benefits all stakeholders. Ultimately, DORA compliance offers a pathway to not only meeting regulatory requirements but also achieving a higher standard of ICT risk mitigation and digital resilience. By adopting DORA compliance, financial services organizations protect themselves, their customers, and the broader financial system against the growing threat of digital disruptions.

KEY TAKEAWAYS

KEY TAKEAWAYS

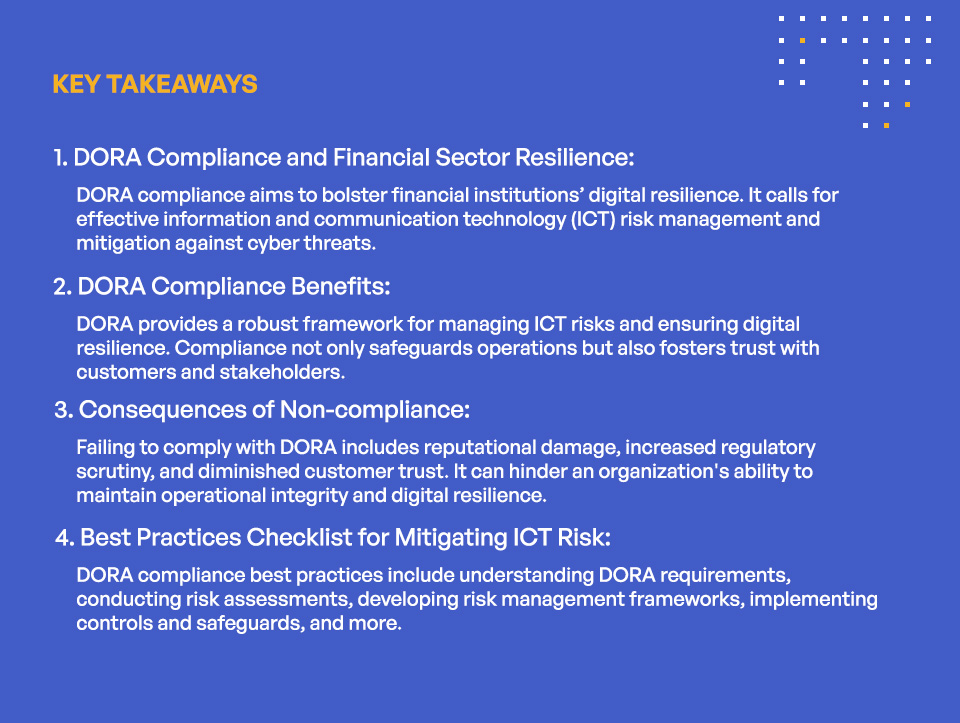

- DORA Compliance and Financial Sector Resilience:

DORA compliance aims to bolster financial entities’ digital resilience. It calls for effective information and communication technology (ICT) risk management and mitigation against cyber threats. - DORA Compliance Benefits:

DORA provides a robust framework for managing ICT risks and ensuring digital resilience. Compliance not only safeguards operations but also fosters trust with customers and stakeholders. - Consequences of Non-compliance:

Failing to comply with DORA includes reputational damage, increased regulatory scrutiny, and diminished customer trust. It can hinder an organization’s ability to maintain operational integrity and digital resilience. - Best Practices Checklist for Mitigating ICT Risk:

DORA compliance best practices include understanding DORA requirements, conducting risk assessments, developing risk management frameworks, implementing controls and safeguards, and more.

Consequences of Non–compliance with DORA

The consequences of failing to comply with DORA can be quite stringent, encompassing a range of penalties that go beyond mere financial repercussions.

These penalties can involve significant fines that not only impact the financial bottom line but can also lead to lasting reputational damage. These consequences can erode customer trust, which is often more challenging to rebuild than it is to maintain.

Organizations found in violation of DORA also face elevated levels of regulatory scrutiny. Increased oversight, where every minor misstep is closely monitored and potentially penalized, can be costly and slow productivity.

Ultimately, DORA compliance requires a critical strategic commitment for organizations to ensure their digital resilience and operational integrity over the long haul. By proactively adopting and implementing a robust ICT risk mitigation strategy that aligns with DORA’s requirements, financial entities can shield themselves effectively against various disruptions, bolster their defenses against cybersecurity threats, and maintain the continuity of their vital financial services.

DORA Compliance Checklist: Best Practices for ICT Risk Mitigation

To demonstrate DORA compliance and ensure a robust approach to ICT risk mitigation, financial services organizations are encouraged to follow these best practices.

1. Understand DORA Requirements

DORA compliance begins with a comprehensive grasp of the intricate ICT risk management mandates it specifies. This initial step is crucial and involves an in–depth examination of not just the regulation text but also any additional guidance or instructions provided by pertinent regulatory bodies overseeing the sector. Financial organizations should first identify specific obligations and expectations related to the management of ICT risks. This includes recognizing the types of incidents that need to be reported, the processes for testing digital operational resilience, and the criteria for assessing third–party service providers, among other aspects.

By learning and understanding the details of DORA requirements, organizations can ensure that their risk management frameworks and controls are not only compliant but also optimized to strengthen their resilience against ICT disruptions.

2. Conduct Risk Assessments

Regular and thorough evaluations of Information and Communication Technology (ICT) infrastructures and operations play a critical role in uncovering potential weaknesses and new threats that could compromise these systems. These risk assessments are vital to ensure the security and reliability of ICT systems, and so their scope should be broad. This means not only focusing on cybersecurity threats, which include attacks such as hacking, phishing, and ransomware, but also considering risks related to the accuracy, consistency, and reliability of data, known as data integrity issues.

By conducting these comprehensive assessments, organizations can gain a clear understanding of the various risks they face. This insight helps organizations craft both reactive as well as preventative strategies like enhancing firewalls, implementing multi–factor authentication (MFA), regularly updating and patching software, or conducting staff training on security awareness. With the insights obtained from risk assessments, organizations are better positioned to allocate their resources and efforts more strategically. If, for example, an assessment reveals that an organization is particularly vulnerable to data breaches due to outdated software, it can prioritize updates and invest in stronger data encryption methods.

3. Develop Risk Management Frameworks

A critical subsequent step in demonstrating DORA compliance is the creation of bespoke risk management frameworks. These frameworks must be meticulously designed to fit an organization’s unique Information and Communications Technology (ICT) environment, as well as its broader business objectives. Designing such a framework entails the establishing detailed policies, procedures, and controls, all essential for managing ICT risks through the entire risk management cycle—from identifying and assessing potential risks to implementing mitigation strategies and the ongoing monitoring of these risks. Once again, the risk management framework should reflect an in–depth understanding of both the organization’s specific ICT landscape and the complex nature of the digital risks it faces.

The effectiveness of a risk management framework lies in its flexibility and ability to evolve. It’s crucial therefore that these frameworks are treated not as fixed blueprints but as versatile, evolving structures capable of adapting to changes in the threat landscape or the organization’s operational context. This dynamic approach to risk management ensures that financial entities remain agile, capable of swiftly responding to ICT incidents.

4. Implement Controls and Safeguards

Mitigating ICT risk requires the implementation of controls and safety measures that focus on minimizing the potential threats an organization faces. Controls include, but are not limited to, robust firewalls, advanced malware protection systems, and secure coding practices. In addition, access controls like role–based permissions ensure that only authorized personnel have access to critical data, significantly reducing the risk of internal and external data breaches. Encryption mechanisms also play a pivotal role in safeguarding data at rest and in transit, ensuring that even if data is compromised, it remains indecipherable and useless to attackers. Incident response procedures and business continuity plans are also essential components of a broad ICT risk management strategy.

Crafting detailed and efficient incident response strategies and business continuity plans ensure that organizations are prepared to promptly and effectively address security incidents, minimizing their impact. Finally, regular security awareness training programs empower every employee to protect an organization’s digital assets.

5. Enhance Cybersecurity Measures

The broader controls and safeguards outlined above are critical but aren’t enough. Organizations must also hone in on cybersecurity–specific risks. These risks encompass a range of cyber threats, including malware attacks, phishing schemes, ransomware attacks, and insider threats like sabotage and misdelivery. To counteract these risks effectively, financial organizations must embrace targeted cybersecurity measures. Deploying multi-factor authentication, for example, significantly enhances user verification processes, making unauthorized access exponentially more challenging for cyber adversaries.

Segmenting networks emerges is another pivotal measure. By dividing the broader network into smaller, controllable segments, organizations can minimize the lateral movement of threats, thereby containing any potential breach to a localized area and reducing the overall impact on the organization. Intrusion detection systems (IDS) continuously monitor network traffic for anomalies, allowing organizations to identify and stop potential threats at their inception.

As mentioned above, educating employees on the various aspects of cyber threats and the best practices for prevention, is also critical. It not only empowers individuals to act as the first line of defense against cyber intrusions but also reinforces the organization’s commitment to maintaining a robust digital operational resilience. By implementing these targeted strategies, organizations can ensure a more secure and resilient digital infrastructure.

6. Ensure Data Protection and Data Privacy Compliance

Financial services organizations are under increasing pressure to uphold stringent regulatory standards, particularly those concerning data protection and privacy. While DORA compliance is critical, it is one of many regulations of which financial services organizations must adhere. The General Data Protection Regulation (GDPR), for example, applies across the European Union. GDPR compliance ensures organizations protect personal data and respect privacy by implementing data protection measures. This includes obtaining consent for data processing, safeguarding data against breaches, and ensuring data subjects’ rights. It’s pivotal for businesses operating in or dealing with individuals within the EU.

The UK’s Data Protection Act 2018 (DPA 2018) is the UK’s implementation of the GDPR, focusing on managing personal data securely and lawfully. It sets out the legal framework for data protection and privacy, emphasizing individuals’ rights over their personal information. Essentially, it mandates organizations to adopt adequate data protection and security measures. Germany’s Federal Data Protection Act (BDSG) is a critical framework designed to protect the personal data of German citizens. It sets stringent guidelines for data handling and privacy, ensuring entities implement robust security measures to safeguard information. This Act emphasizes the importance of privacy rights, making compliance crucial for businesses operating within the country.

By ensuring your organization adheres to these and other data privacy regulations, you can better identify and mitigate any risks associated with your data processing activities.

7. Establish Incident Response Capabilities

To ensure the resilience and security of Information and Communication Technology (ICT) systems, it’s crucial to develop robust incident response capabilities that enable organizations to effectively detect, respond to, and recover from various ICT incidents and disruptions. This multifaceted approach involves several key steps, including establishing an incident response plan, incident response teams, defining escalation procedures, and conducting regular incident response exercises and simulations.

The primary goals of these exercises are to test the effectiveness of the organization’s incident response plan, identify any weaknesses or gaps in preparedness, and enhance the team’s readiness to handle real–world incidents. Through continuous improvement and regular training, organizations can ensure that their incident response teams are well–prepared to manage the complexities of ICT incidents. Organizations can, in turn, protect their information assets, maintain trust with stakeholders, and ensure business continuity in the face of increasing cyber threats.

8. Monitor and Report Compliance

DORA compliance requires financial services organizations to adopt a proactive stance in overseeing their risk management processes. This entails the creation and implementation of a structured, continuous monitoring framework that scrutinizes the effectiveness and compliance of risk management strategies and practices in real–time. By doing so, financial services organizations not only safeguard their operations against potential ICT risks but also ensure that these efforts are consistently aligned with the stringent requirements outlined in DORA (and surely other data privacy regulations).

Also, establish communication procedures and channels for the transparent and timely reporting of ICT risk–related issues. Develop detailed protocols and mechanisms that facilitate the systematic reporting to key internal and external stakeholders. Alert senior management within the organization of any emerging or identified risks so they may make informed decisions and take corrective actions where necessary.

Similarly, notify regulatory authorities, in accordance with DORA’s reporting requirements, to ensure compliance and facilitate regulatory oversight. Other stakeholders, including clients, partners, and shareholders, might also need to be informed, depending on the nature of the risk and its potential impact on their interests. This approach ensures that all parties involved are well–informed and can collaborate effectively in mitigating ICT risks to enhance an organization’s overall resilience and reliability.

9. Engage in Regulatory Dialogue

As a follow on from the above best practice, it’s pivotal for organizations to engage directly and proactively with pertinent regulatory bodies. DORA compliance requires a collaborative dialogue where organizations seek clarity, offer insights into practical challenges, and align their operational practices with the expectations laid out by the regulation. Such an engagement is essential for adapting to DORA’s regulatory nuances and understanding the intent behind various requirements. It also facilitates a smoother implementation process.

Participation in industry forums, working groups, and consultations represents another critical strategy for staying abreast of regulatory changes and emerging best practices. These platforms offer a communal space for organizations to exchange insights, discuss interpretation challenges, and benchmark their practices against industry standards. Active involvement in these forums enables organizations to anticipate regulatory shifts, adapt to new requirements, and implement best practices that not only comply with existing regulations but also position them favorably for future regulatory developments.

Through these collaborations, organizations can collectively voice their concerns, propose adjustments or enhancements to regulatory approaches, and contribute to the development of more effective and balanced regulatory frameworks. This proactive approach is indispensable for understanding, preparing for, and adhering to the complexities and nuances of today’s dynamic regulatory environment. It ensures that organizations not only meet the current standards but are also well–prepared for upcoming challenges and changes.

10. Strive for Continuous Improvement

To effectively manage ICT risks, it’s crucial to cultivate an environment that is not only responsive to current challenges but also adaptable to future shifts and threats. This involves implementing a dynamic, iterative process for evaluating and refining the organization’s risk management strategies. Recognize that the landscape of ICT risks is perpetually evolving, driven by rapid technological advancements, the emergence of sophisticated cyber threats, and fluctuations in regulatory requirements.

To stay ahead, organizations should commit to a systematic, ongoing review of their risk management framework. This encompasses a thorough examination of existing policies, procedures, and controls to identify any gaps or weaknesses that might expose the organization to ICT risks. By doing so, businesses can ensure that their risk management practices are robust, relevant, and aligned with the latest industry standards and best practices. Secondly, learning from past incidents plays a critical role in fostering a culture of continuous improvement.

Every security breach, attempted attack, or system failure provides invaluable insights into the effectiveness of current risk mitigation strategies. Analyzing these incidents to understand what went wrong, what worked, and how different approaches could have yielded better outcomes is fundamental. Finally, staying attuned to changes in the regulatory landscape is vital for ensuring compliance and protecting against legal and financial repercussions. Laws and regulations governing ICT practices are frequently updated to address new vulnerabilities and protect consumer data better. Organizations must therefore regularly review their compliance status and adjust their policies and procedures accordingly to meet these evolving standards.

Kiteworks Helps Financial Services Organizations Demonstrate DORA Compliance with a Private Content Network

The essence of DORA compliance lies in its holistic approach to managing and mitigating ICT risks, which is crucial for the stability and integrity of the financial sector. Adherence to DORA’s IT security standards, risk management requirements, and incident reporting protocols not only minimizes the risk of significant penalties and reputational damage but also builds and reinforces trust with customers and stakeholders. By following these best practices and continuously engaging in improvement and regulatory dialogue, financial entities can safeguard their operations, data, and services against emerging ICT threats, thus ensuring long–term operational resilience and integrity.

With Kiteworks, businesses share confidential personally identifiable and protected health information (PII/PHI), customer records, financial information, and other sensitive content with colleagues, clients, or external partners. Because they use Kiteworks, they know their sensitive data and priceless intellectual property remains confidential and is shared in compliance with relevant regulations like GDPR, HIPAA, U.S. state privacy laws, and many others.

Kiteworks deployment options include on-premises, hosted, private, hybrid, and FedRAMP virtual private cloud. With Kiteworks: control access to sensitive content; protect it when it’s shared externally using automated end-to-end encryption, multi-factor authentication, and security infrastructure integrations; see, track, and report all file activity, namely who sends what to whom, when, and how. Finally demonstrate compliance with regulations and standards like GDPR, HIPAA, CMMC, Cyber Essentials Plus, NIS2, and many more.

To learn more about Kiteworks, schedule a custom demo today.

Additional Resources

- Brief Kiteworks Enables Robust FINMA Circular 2023/1 “Operational risks and resilience – banks” Regulatory Compliance

- Brief Sensitive Content Communications Privacy and Compliance in Financial Services

- Webinar Assessing the Maturity of Digital Communications Privacy and Compliance in Financial Services and FinTech

- Brief Navigating DORA Compliance With Kiteworks

- Guide The Financial Services Solution Guide to DORA Regulation UK